Funding supports further development of joint data-driven drone software solutions for cloud-based asset information modeling

Agreement builds on existing relationship that leverages Delair’s industry-optimized software analytics and Intel’s cloud computing strategy to bring new levels of business intelligence to commercial enterprises

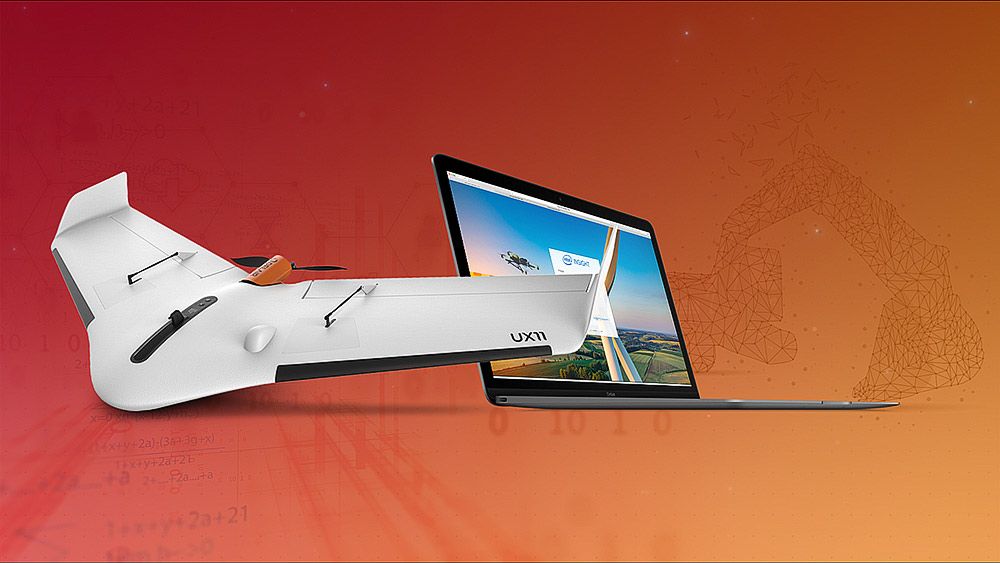

TOULOUSE, France – September 13, 2018 – Delair, a leading global supplier of commercial drone solutions, today announced that it has recently closed its expansion round with an investment from Intel Capital. For the past year, Delair and Intel have been collaborating on the Intel® Insight Platform, a cloud-based digital asset management solution that leverages Delair’s extensive suite of industry-optimized software analytics to speed Intel’s efforts to transform how businesses in key verticals work using data captured from UAVs for actionable analytics.

TOULOUSE, France – September 13, 2018 – Delair, a leading global supplier of commercial drone solutions, today announced that it has recently closed its expansion round with an investment from Intel Capital. For the past year, Delair and Intel have been collaborating on the Intel® Insight Platform, a cloud-based digital asset management solution that leverages Delair’s extensive suite of industry-optimized software analytics to speed Intel’s efforts to transform how businesses in key verticals work using data captured from UAVs for actionable analytics.

The funding will be used to further accelerate the development and adoption of the Intel Insight Platform – a data processing, visualization, analytics and reporting service that allows customers to store organize, share, and harness the rich data provided by commercial drone systems. The platform integrates Delair’s deep customer experience and vertical expertise with Intel’s expertise in developing customer-focused, easy to use cloud-based solutions and tools.

“This investment, built on an ongoing relationship with Delair will help make aerial-based data collection and analysis an effective business intelligence approach for more enterprises. Delair and Intel are continuing to drive forward innovation and capabilities to enable a new level of digital transformation by customers,” said Anil Nanduri, Vice President, General Manager of Drones Group, Intel Corporation.

The Intel and Delair strategic collaboration on the digital asset management solution has been deployed to strategic enterprise customers across several industries. The solution leverages the companies’ expertise providing customers with aerial data that can be used to generate 2D/3D models, take measurements, enable sharing and collaboration across teams and run a wide-range of data analytics and monitoring tools.

Michael de Lagarde, CEO of Delair, said: “Data is the future of the commercial drone business and that’s why we are excited about this investment from Intel Capital. Intel brings a wealth of technical expertise and experience, as well as new enterprise customers. Whilst Delair’s innovation on the hardware side of our UAV offering is well recognized, our relationship with Intel provides us with increased resources to build out the critical data analysis software components of our UAV solution – an area where we believe we can truly differentiate and bring additional value to customers.”

END

About Delair

Delair is a leading provider of drone-based solutions that enable enterprises to monitor and digitize their physical assets from the air and turn the collected data into valuable business insights. Its solutions are used globally by customers in industries such as utilities, construction, agriculture, transportation, mining and oil and gas. The company is one of the world’s most experienced providers of industrial drone solutions, combining its high performance, long range UAV hardware with sophisticated analytics technology and operational services. A strategic relationship with Intel and the Intel Insight Platform is driving the two companies toward designing the industry’s most scalable platform for drone imagery storage and business intelligence. Founded in 2011 by experts in the aerospace industry, the company is headquartered in Toulouse, France, and has offices in Ghent, Belgium, Los Angeles and Singapore. Its solutions are sold in more than 70 countries by a network of distributors. For more information about Delair and its brand-new generation of beyond-visual-line-of-sight (BVLOS) drones with 3G/4G communications, go to www.delair.aero and on twitter @DelairTech

About Intel Capital

Intel Capital invests in innovative startups targeting artificial intelligence, autonomous driving, workload accelerators, 5G connectivity, virtual reality and a wide range of other disruptive technologies. Since 1991, Intel Capital has invested US $12.3 billion in 1,530 companies worldwide, and more than 660 portfolio companies have gone public or been acquired. Intel Capital curates thousands of business development introductions each year between its portfolio companies and the Global 2000. For more information on what makes Intel Capital one of the world’s most powerful venture capital firms, visit www.intelcapital.com or follow @Intelcapital.